Chartered Accountancy is one of the most preferred career options after 12th or Graduation for commerce students. The CA Course or Chartered Accountant Course is divided into three levels, i.e.

- CA Foundation

- CA Intermediate

- CA Final

The Chartered Accountancy (CA) exam is organized by The Institute of Chartered Accountants of India (ICAI). These exams take place two times each year, in May and November. ICAI provides all the information regarding CA courses, including the syllabus, exam format, registration details, eligibility criteria, and exam fees.

Students who wish to register for the course must know all the details regarding the Chartered Accountancy Course. This guide will provide you with all CA course details after 12th, including the syllabus, fee structure, How to become CA, course duration, and CA Salary in India.

TABLE OF CONTENT

- CA Course Details

- What is Chartered Accountancy?

- How to Become CA

- CA Course fees for Foundation, Intermediate, and Final

- CA Course Duration

- Eligibility Criteria For CA Course at Each Level

- Chartered Accountancy Course Registration

- Chartered Accountancy Subjects

- Best Books for Chartered Accountancy Course

- Passing Criteria for CA Course

- CA Salary in India

- Scope After CA Course in India

- Trainings in Chartered Accountancy Course

- Skills Required to become CA

- Career Options For CA

- Frequently Asked Questions

CA Course Details – An Overview

| Particulars | Details |

| Full-Form | Chartered Accountancy |

| Conducting Body | ICAI (The Institute of Chartered Accountants of India) |

| Duration | 4 Years |

| Levels | 3 Levels+ Articleship |

| Degree | Bachelor’s |

| CA Course Eligibility | For Foundation Route: After Class 12th (min 50% marks in class 12th) and For Direct Entry Route: Graduation |

| CA salary in India | 7-8 Lakhs |

| Fees | 3-4 Lakhs |

| Job Role | Accountant, Banker, Financial Manager, Consultor, Auditor |

Key Takeaway of the CA Course

The Chartered Accountancy Course is divided into three levels i.e. CA Foundation, CA Intermediate and CA Final. To become a CA in India, you must pass all these three levels of CA, including three years of Articleship Training. Thus, it takes a minimum of 5 years for you to become CA after the 12th.

Chartered Accountancy Course Details:

- Eligibility: 50% in Class 12th

- Fees: 3-4 Lakhs

- CA Salary: 7-8 Lakhs

- Job Role: Accountant, Banker, Auditor Etc

- Duration: 4 Years (Minimum)

What is Chartered Accountancy?

Chartered Accountancy (CA) is a profession that deals with accountancy, finance, taxation, law, and Auditing. A CA gives financial advice, audits accounts, and provides information related to the financial sector. Therefore, a CA is responsible for preparing auditing, and managing financial books every month. The job roles of a CA are Accountant, Banker, Financial Manager, Consultor, Auditor, etc.

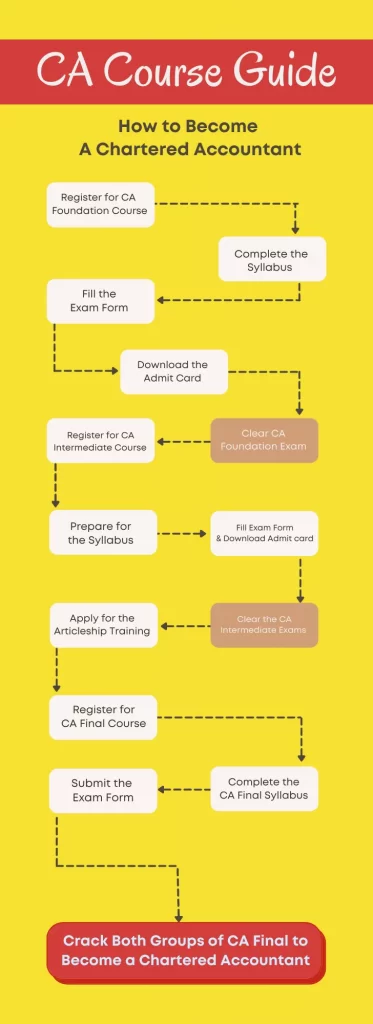

How to Become a CA in India?

To become a CA in India, students need to go through the following steps:

- Register for the CA Foundation Course

- Pass the CA Foundation Exam.

- Register for the CA Intermediate Course.

- Pass any one single group of CA Intermediate.

- Enrol for CA Articleship training.

- Pass both groups of CA Intermediate

- Complete 3 Years of Article training.

- Register for the CA Final Course.

- Pass Both Groups of CA Final.

- Apply for ICAI Journal Membership.

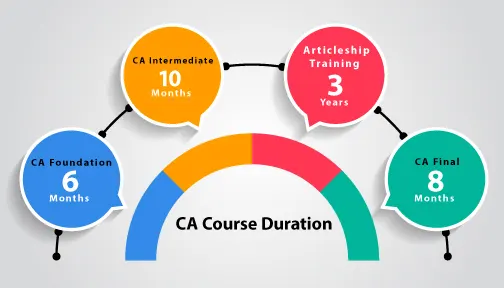

CA Course Duration

Before joining the course, every candidate wants to know how much time duration the course will take to complete. The total duration of the CA course is five years, and to become a CA, students must pass all three levels with three years of articleship training. However, the total CA course duration after graduation is 4.5 years.

The step-by-step procedure and CA Course duration after the 12th will be:

Step 1: Timeline in Passing 12th to Clearing CA Foundation Level= 4 Months (Mandatory Study Period in between registration and examination date is 4 Months)

Step 2: Timeline in Passing Foundation level to pass Intermediate Level = 8 Months (Mandatory Study Period between registration and examination date is 8 Months)

Step 3: Timeline in passing CA Intermediate to passing finals = 3.5 Years (Articleship is for three years and Study time period for Finals is assumed to be 5 Months)

ICAI CA Course fees for Foundation, Intermediate, and Final

The total fee for CA Course for 5 years is Rs. 87,300 after class 12th and the total fee after graduation is Rs.76,200.

| CA Course fees | Indian Student | Foreigner Student |

| CA Foundation | ₹11,300 | $1105 |

| CA Intermediate- Single Group | ₹28,000 | $925 |

| CA Intermediate- Both Group | ₹34,200 | $1500 |

| CA Intermediate- Direct Entry | ₹34,400 | $1500 |

| Articleship Fee | ₹2,000 | |

| CA Final | ₹39,800 | $1650 |

| Total | ₹87,300 | $4255 |

The total fee only includes the fee for the registration and examination form. Hence, the fee for coaching is approximately 2-3 lakhs for 5 years.

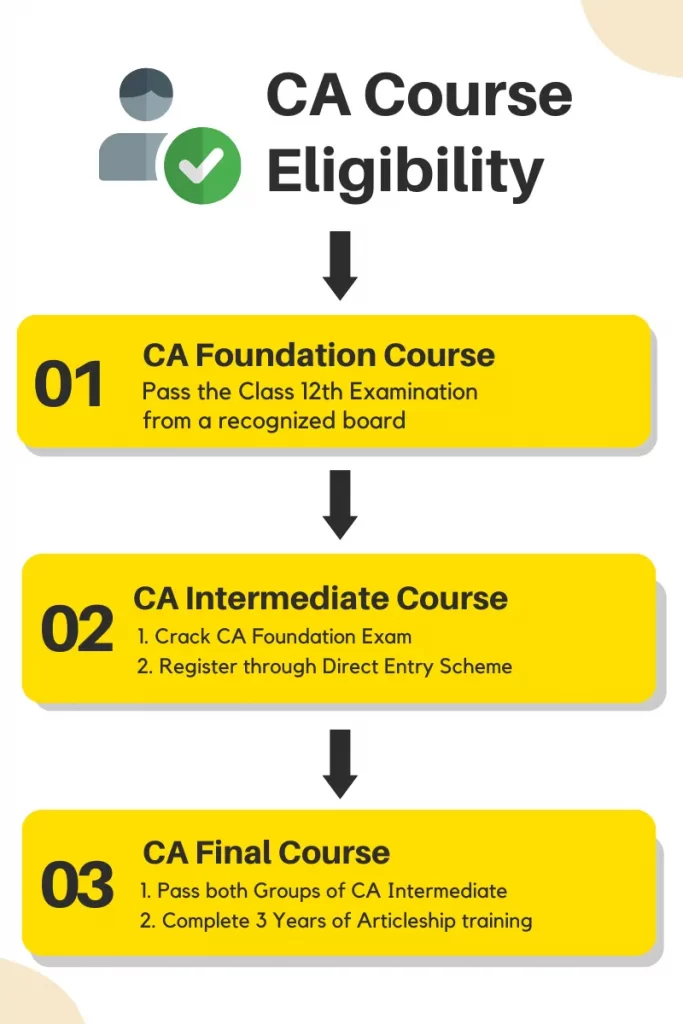

Eligibility Criteria For CA Course at each level

Before registering for the CA Course, one must know the eligibility criteria for the course; if the candidates fulfil the eligibility criteria, then they can register for the CA Course.

- CA Foundation: For registering for the CA Foundation course, the student must have passed the Class 12th exam with a minimum of 50% in the commerce stream and with a minimum of 55% if the candidate is from the science stream.

- CA Intermediate: Students can register for the CA Intermediate course in two ways:

- Through the CA Foundation route: The candidate needs to clear the CA Foundation exam with a minimum of 50%.

- Through the Direct entry route: Students can enrol for the CA Intermediate exam without taking the foundation exam through the direct entry scheme. The eligibility criteria for Direct entry scheme students are:

- Students who are Graduates/postgraduates in commerce and secured a minimum of 55% can register directly for Intermediate without passing CA Foundation or CPT.

- Non-commerce Graduates/ Post Graduates can also register for Intermediate by securing 60% marks in Graduation/ Post Graduation.

- Apart from the above, the students who cleared the Intermediate level of the Institute of Cost Accountants of India or The Institute of Company Secretaries of India.

3. CA Final: For the CA Final exam, students need to clear both groups of CA Intermediate and 2.5 years of articleship training.

Also, read: Download the CA Foundation Paper and CA Intermediate Paper.

Chartered Accountancy Course Registration

If the Students fulfil the eligibility criteria, then they can register for CA Course. Students need to fill out the registration form on the ICAI official Website. The forms are open around the whole year, but the deadlines are set.

For the CA Foundation and Final Session, the last date to fill out the registration form for the May attempt is 1 Jan, and for the Nov session, it is 1 Jul. For the CA Intermediate May session, the last date is 1 Sept, and for Nov, the attempt is 1 Mar.

Documents Required For CA Course Registration

Some documents are required during the registration for the CA Course. Check the list of documents required of the CA Foundation:

- Class 10th Marksheet

- Class 12th Marksheet

- Passport Size photo

- Nationality Proof (Required for Foreign Students)

- CA Foundation Marksheet (For CA Intermediate Registration)

- CA Intermediate Marksheet (For CA Final Registration)

- Articleship Certificate (For CA Final Registration)

How to Register for CA Course?

After you have arranged all the documents, it’s time to know how to register for the CA Course. However, the CA Foundation is the first level, so apply for CA Foundation by following the steps below:

- Visit the ICAI official website.

- Now, create a new account by entering your basic details, such as your name, contact number and Email.

- Now, verify the OTP sent in your mail and complete the verification process.

- Now you have your login credentials, so log in now using them,

- Afterwards, click on “Apply for the foundation.

- Now, the registration form will appear on your screen.

- Now, enter the required details and then click on next.

- Now, upload all the necessary documents.

- Click and save next.

- Lastly, pay the registration fee. Hence, you are registered for the course.

Therefore, for the CA Intermediate and CA Final, the same procedure is been followed. However, by the time you will register for the CA Intermediate and final all your details will be auto-filled, you only need to log in with the same registration and ID and upload the different documents.

Further, the fee for the CA Course registration:

| Course | Registration Fee (Indian Students) | Registration Fee (Overseas Students) |

| CA Foundation | Rs.9800 | $780 |

| CA Intermediate | Rs.15000 (Both Groups) Rs.11000 (Single Group) |

$1000 (Both Groups) $600 (Single Group) |

| CA Final | Rs 22000 | $1100 |

Chartered Accountancy Subjects

As seen above, the CA Course is divided into three levels, i.e. CA Foundation, Intermediate, and CA Final. Download the Complete CA Syllabus for all three subjects of the Chartered Accountant Course:

CA Foundation Syllabus 2024

The CA Foundation syllabus is divided into 4 subjects, which include accounts, laws, quantitative aptitude, and economics.

Paper 1: Accounting

Paper 2: Business Laws

Paper 3: Quantitative Aptitude

Paper 4: Business Economics

CA Intermediate Syllabus 2024

The CA Intermediate Syllabus is divided into two groups, and each group consists of 3 subjects:

Group 1 –

Paper 1: Accounting

Paper 2: Corporate and Other Laws

Paper 3: Taxation

- Section A: Income Tax Law

- Section B: Goods and Service Tax

Group 2 –

Paper 4: Cost and Management Accounting

Paper 5: Auditing and Assurance

Paper 6: Financial Management and Strategic Management

- Part A: Financial Management

- Part B: Strategic Management

CA Final Syllabus and Subjects 2024

The CA Final Syllabus consists of eight subjects, which are divided into two groups, and each group is comprised of 3 subjects:

Group 1:

Paper 1: Financial Reporting

Paper 2: Advanced Financial Management

Paper 3: Advanced Auditing, Assurance and Professional Ethics

Group 2:

Paper 4: Direct Tax Laws and International Taxation

Paper 5: Indirect Tax Laws

Paper 6: Integrated Business Solution

- Section A- Corporate and Economic Laws

- Section B- Strategic Cost & Performance Management

Also, check about CMA Foundation Course, and CMA Intermediate Course

Best Books for Chartered Accountancy Course

There are a lot of Reference books on the Chartered Accountancy Course. However, it is suggested that the students use ICAI Study Material. But in case, if you want to use reference books then you can go for these books:

CA Foundation Books

- Fundamentals of Accounting – D.G. Sharma

- General Economics – S.K. Agarwal

- Mercantile Laws for CA Foundation – PC Tulsian

- Quantitative Aptitude Mathematics with short Tricks – CA Rajesh Jogani

- Quantitative Aptitude – Dr T. Padma and KCP Rao

- Padhuka Basics of Accounting for CA Foundation – G. Sekar & b Saravana Prasth

CA Intermediate Books

- First Lesson in Accounting Standards – MP Vijay Kumar

- A Handbook on Corporate and Other Laws – Munish

- Padhukas Students Handbook on CMA – CA B. Sarvana

- Padhuka’s Students Handbook on Advanced Accounting – CA G. Sekar and CA B. Saravana Prasath

- Information Technology (IT) – Dinesh Madan

CA Final Books

- Accounting Standards – D.S Rawat

- Accounting Standard & INDAs – CA Praveen Sharma

- SFM Module with Solution – Rahul Malkan

- Handbook – CA Munish Bhandari

Download the CA Final Paper with the suggested Answer.

Passing Criteria for CA Foundation, Intermediate, and CA Final

The passing criteria for all three exams are almost similar. To pass the CA Foundation Course, the students must secure a minimum of 40% in Each subject and 50% aggregate.

However, to pass the CA Intermediate and CA Final Exam, the candidate must secure 40% in each subject and 50% aggregate in each group.

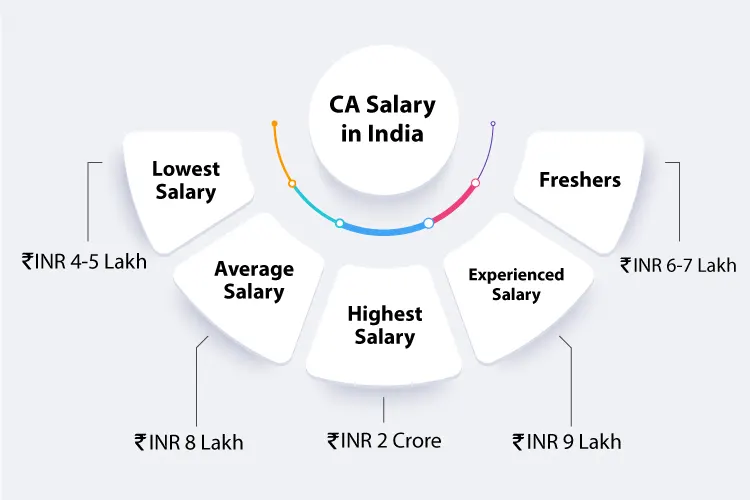

CA Salary In India

The average CA Salary for freshers in India is about 7-8 Lakhs and it rises up to 70 Lakhs according to experience and skills. Moreover, the salary of a Chartered Accountant depends upon their experience, job roles, knowledge, and ranks. Further, to get a higher package, students must score a high rank in the CA Final Exam.

Furthermore, the students with the ranks in the CA Final exam get priority and placement with a higher package. Check the image below to know the CA Salary in India:

You have seen the CA Course details after class 12th, now let’s look at some of the job positions of CA.

Also, Check CMA Salary in India

Scope after CA Course in India in 2024

When it comes to the scope of Chartered Accountancy, then this course has ample opportunities as the demand for the CA is increasing rapidly. Therefore, the primary reason for high demand is that there are fewer numbers of CA than required.

Also, nowadays, after the implementation of the new roles and taxation policy, the demand has increased more. Further, the demand graph of the CA is always going to move in an upward direction.

The CA in India can work in various sections, such as:

- CA Firm

- Financial Institution

- Business

- Consultancy Firm

- Independent Practice

Training in Chartered Accountancy Course

Training is a compulsory part of the Chartered Accountant Course. It is the third stage of the course, and without training, the student is not eligible for the CA Final Exam. There is a total of 4 pieces of training in the chartered accountancy course, which includes three years of articleship training. These trainings are:

- ICITSS Training

- AICITSS Training

- Articleship Training

- Industrial Training

ICITSS Training

ICITSS (Integrated Course on Information Technology and Soft Skills) is the first training to develop the knowledge of Information Technology and Soft Skills in students. This training is for one month, which includes 15 days of IT Training and 15 Days Orientation Program.

Articleship Training

The articleship training is a 3-year training program in which the students gain practical knowledge and experience for CA work. The students are only eligible for the articleship training after passing any one group of the CA Intermediate. Also, to apply for the articleship training, students must undergo the ICITSS Training.

After completing three years of articleship training, students can register for the CA Final course.

AICITSS Training

The ICAI offers a required training program called AICITSS, or Advanced Integrated Course on Information Technology and Soft Skills. You will learn two skills in this training: advanced IT and management and communication abilities. For each talent, 15 days are needed to finish.

The primary goal of this program is to equip candidates with a variety of abilities, including communication, presentation, leadership, and business environment comprehension. As a result, this training aids CA students in landing their dream jobs.

Industrial Training

Industrial training is optional for CA aspirants to provide candidates with industrial understanding and functioning. Therefore, individuals who are interested in developing their careers in the industry might choose ICAI’s industrial training programme. This training course is optional and subject to the candidates’ preferences.

Skills Required to Become a CA

Candidates for chartered accountant jobs should possess the following abilities:

- Good Communication

- Analytical Skills.

- Confidentiality

- Ethics

- Honesty and Accountability

- Ability to constantly learn new things

Career Options for CA

A candidate who has passed the CA Examination is eligible for the following job opportunities. However, there are different sectors related to finance and taxation. So, there are various career options for them.

- Chartered Accountant

- Financial Manager

- Financial Advisor

- Financial Analyst

- Auditor

- Internal Auditor

- Public Accountant

- Cost Accountant

- Government Accountant

- Taxation Expert

- Accounting Firm Manager

Important Note: ICAI will implement the CA new scheme from the May 2024 attempt. Students can check the complete details from the given link.

Frequently Asked Question – CA Course Details After 12th

Q1. What is the duration of the CA Course?

Ans: The total duration of the Chartered Accountant Course after class 12th is 5 years.

Q2. What are the subjects in CA?

Ans: In CA, the students will have different subjects at each level, namely, Accounts, Maths, Law, Tax, Audit, and Costing.

Q3. Is CA a three-year course?

Ans: No, the minimum course duration is 4.5 years.

Q4. How difficult is CA?

Ans: CA is considered to be the most difficult exam of all. At each level of the course the difficulty level increases. But one can easily pass the exam through hard work.

Q5. What is the qualification for the CA Course?

Ans: You must receive a passing grade on your class 12th exam in order to be eligible for the CA Course. Graduates with a background in business must receive at least a 55% grade, while those with a background in science must receive at least a 60% grade.

Q6. What is the average salary of a CA in India?

Ans: The average salary of a CA (Chartered Accountant) in India is Rs. 7-8 lakhs per annum.

Q7. What is the registration fees of CA courses?

Ans: The fees for the CA Course registration are given below:

- CA Foundation: INR 9,800

- CA Intermediate: INR 18,000

- CA Final: INR 22,000