Chartered Accountancy is one of the most preferred options for commerce students. But before registering for the course, the question arises How to Become a CA in India. If you have this question, you’ve chosen the right article. Here, we will tell you the step-by-step procedure to become a Chartered Accountant in India and complete details about the CA course. So, stay tuned with us till the end.

Table of Content

What is Chartered Accountancy?

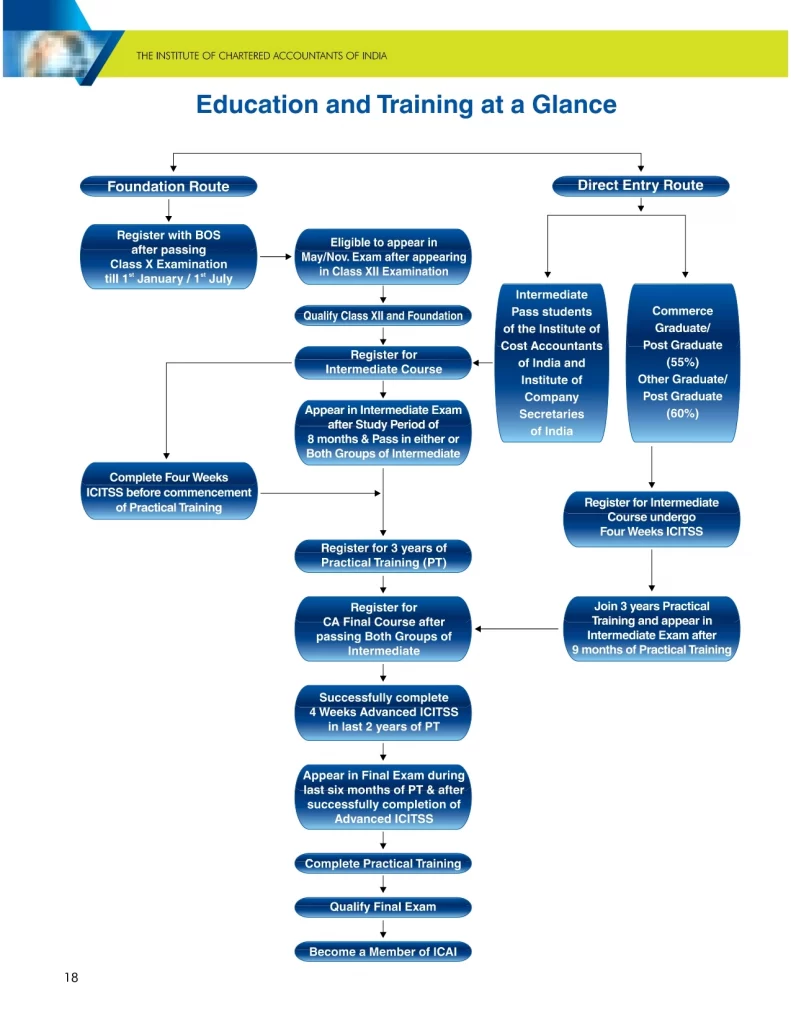

Chartered Accountancy is a profession that deals with accounts, taxation, and finances, and with the boom of the financial sector in India, the demand for Chartered Accountants has also increased. To become a Chartered Accountant in India, students can go in 2 ways:

- Through CA Foundation

- Through Direct Entry Route

1. Steps to Become CA in India through Foundation Route

Source: ICAI

Step 1: Pass CA Foundation Exam

CA Foundation is the entry-level exam or the 1st stage of the CA course.

Eligibility/Qualification

For eligibility in the CA Course students need to pass the class 12th examination with a minimum of 50% (commerce Students) and a minimum of 55% is required for Science students.

Foundation Registration

To register for this course you will fill out the online registration form available on the ICAI official website. After successful CA Foundation registration and payment of the prescribed fees, you will have to submit the following documents within 7 days from the online registration along with the hard copy of the online form duly signed by the candidate.

- Attested a copy of the Admit Card/ Marksheet of the 12th examination issued by the respective board.

- One latest coloured photographs should be affixed to the online registration form.

- Attested copy of the proof of Nationality, if the student is a foreigner.

- Attested copy of the proof of special category certificate i.e. ST/SC/OBC.

- Attested copy of 10th Admit card or Marksheet.

After such a registration procedure is completed, ICAI will send you the CA foundation study material through the Centralised Dispatch System.

Exam Form

After registration students have to fill out the CA Foundation Examination form. ICAI announces the date for filling out the Examination form. Forms are to be filled out on the ICAI website.

Foundation Syllabus

CA Foundation Syllabus consists of 4 subjects. Paper two will be subjective and the remaining two will be objective. Negative Marking will continue to be in the objective papers.

- Paper 1: Accounting

- Paper 2: Business Laws

- Paper 3: Quantitative Aptitude

- Paper 4: Business Economics

Passing Criteria

Candidates will be declared passed this examination only if they have obtained 40% marks in each individual paper and 50% in aggregate of all the papers. Also, the candidate to note that Foundation objective papers contain negative markings.

Also Check: CA Foundation Result Dec 2023

Step 2: Pass CA Intermediate Exams

After clearing the Foundation level students will be on the next journey or next level i.e. ICAI Intermediate Exam. This level is tougher than ICAI Foundation. Check the details below for Intermediate exams:

Eligibility

The students will become eligible to register for CA intermediate either by clearing ICAI Foundation or through the direct entry route. Direct entry students can be Commerce Graduates students can get direct entry in the ICAI Intermediate only if they secured a minimum percentage of 50% in graduation and science graduate with a minimum of 55%. Also, the students who have cleared ICWA or CS Intermediate.

Intermediate Registration

You can register for this course from the ICAI official website under the student’s tab in course Registration forms. You need to fill out the registration form and make the payment of the prescribed fees. After filing such form and making payment of the prescribed fees, submit a hard copy of such form along with the following documents to the concerned regional office within 7 days –

- Foundation Route students have to submit the 12th or its equivalent recognized mark sheet.

- Direct Entry Route students will have to submit-

- In the case of Graduates / Post Graduates students, an attested copy of the Marksheet or Mark statement.

- Intermediate Level passed students of Institute of Company Secretaries and Cost Accountants of India, their attested copy of Marksheet of Intermediate Level.

- Your latest coloured photograph should be affixed to the hard copy of the online registration form.

- Attested copy of the proof of Nationality, if the student is Foreigner.

- Attested copy of the proof of the Special Category Certificate i.e. SC/ST/OBC

The above documents shall be submitted along with the print of the online registration form duly signed by the candidate.

Training

Students need to complete 4 weeks of training in ICITSS along with the preparation.

Exam Form

After registration students have to fill out the ICAI Intermediate Examination form. ICAI announces the date for filling out the Examination form. Forms are to be filled out on the ICAI website.

Intermediate Syllabus

The ICAI Intermediate syllabus is divided into two groups and each group has 3 subjects:

- Group I

- Paper 1: Advanced Accounting

- Paper 2: Corporate & Other Laws

- Paper 3: Taxation

- Group II

- Paper 4: Cost and Management Accounting

- Paper 5: Auditing and Ethics

- Paper 6: Financial Management and Strategic Management

Note – To appear in the examination, one has to undergo a study period of not less than eight months.

Passing Criteria

In order to clear this exam or a student is declared to have passed this exam only if he secured a minimum of 40% in each paper and 50% in aggregate of all the papers.

A student at one time can appear either in both groups or in a single group. And he will be declared to clear this exam only after passing both groups. If a student secures 60% or more marks on any paper then that paper will be exempt for the next three following attempts. He will not require to give that paper in the following three attempts.

Also Check: CA Intermediate Result Nov 2023

Step 3: Complete 3 Years of CA Articleship Training

Candidates can start their articleship training just after clearing any of the groups of ICAI Intermediate. Before that students should make sure that they have completed ITT and OT programs. Then only they can register for ICAI articleship training.

The Articleship training is a very important part of the entire CA Course. This training helps you a lot in applying theoretical knowledge to practical work, shaping you into a professional, following your ethical values, and learning how to survive in the business world.

The duration of the CA Articleship training is reduced to two years from three years under the CA New Scheme.

Commencement of the Articleship training:-

- The students from the normal route or we can say who have passed the ICAI Foundation can commence their practical training after clearing either single or both the groups of Intermediate and also completing 4 weeks of ICITSS (Information Technology and Orientation Program).

- The students from the direct entry route –

- Graduates / Post Graduates – They have to register for the practical training immediately after the registration in the Intermediate course and completion of 4 weeks of ICITSS( Information Technology and Orientation program ). However, they can appear in the Intermediate examinations only after the completion of 9 months of practical training.

- Intermediate passed students of ICSI/ CMA- Students through the direct entry route who have cleared their intermediate levels of the respective exams can register for the practical training after passing either single or both the groups of Intermediate and completion of ICITSS.

The student can register for the practical training by submitting Form 103 and an agreement for such training is to be entered with the Principal on Form 102.

During the last year of practical training, a student has to complete 4 weeks of Advanced ICITSS. It consists of Information Technology and Management and Communication Skills each for 15 days.

Step 4: Pass CA Final Exams

The last step in the CA Student journey is ICAI Final. Last and also the toughest level. A student can register for CA final course only after passing the second level i.e. Intermediate level then only he will become eligible to register for the Final Course.

Eligible

A student is eligible for the Final Examination only when

- After Passing the ICAI Intermediate Exam

- Either completed his/her practical training or served the last six months of practical training, including excess leaves if any, on the first of the month in which the exam is to be held.

- Also successfully completed an advanced integrated course on information technology and soft skills (Adv. IT & MCS).

Final Registration

One can get register for the Final Course from the ICAI portal under the student’s tab in the course registration forms by making the payment prescribed by the ICAI. After successful submission of the online registration form to the portal, one has to submit its printout to the concerned regional office within 7 days of the online registration along with the following documents:-

- Attested copy of the proof of Nationality if the student is a foreigner.

- Attested copy of the proof of special category certificate i.e. ST/SC/OBC

- After completion of the above registration procedure, ICAI will send the study material through the Centralised Dispatch System to the students.

- A Resident student can get register for this course with a payment of Rs 22000/- and a Foreigner student can register with a payment of 1100 US($).

Exam Form

After registration students have to fill out the CA Final Examination form. ICAI announces the date for filling out the Examination form. Forms are to be filled out on the ICAI website.

Final Syllabus

The Final Level comprises eight subjects divided into two groups:-

Group 1

- Paper 1: Financial Reporting

- Paper 2: Strategic Financial Management

- Paper 3: Advanced Auditing and Professional Ethics

Group 2

- Paper 4: Direct Tax Laws & International Taxation

- Paper 5: Indirect Tax Laws

- Paper 6: Integrated Business Solutions (Multidisciplinary Case Study with Strategic Management)

Passing Criteria

To clear the ICAI Final examination one has to obtain 40% marks on each paper and also 50% marks in aggregate of all the papers.

However, if a student obtains 60% marks in any subject then that subject will be exempt from the further three examinations. But if the student would not able to clear the Final Examination within three attempts, then they will have to again attempt that previous exempt paper.

Students can attempt either single or both groups at a time. And after passing both groups and successful completion practical training you will be a Chartered Accountant. You can apply for the membership number with the ICAI.

You will be a member of ICAI.

Also Check: CA Final Result Nov 2023

2. Through Direct Entry Route (CA After Graduation)

There is also a Direct Entry Route system in CA Course in which some students get benefited, they do not have to pass the entry-level exam i.e. CA Foundation. By this route, they can get direct entry into CA Intermediate.

List of the students along with their requirements to get entry directly through this route:-

- Commerce Graduates/Post Graduates:- Commerce Graduates students can get direct entry into the CA Intermediate only if they secured a minimum percentage of 55% in graduation.

- Non-Commerce Graduates/Post Graduates:- They can also get direct entry into the CA Intermediate only by securing a minimum of 60% marks in graduation.

- ICSI students:- These students who cleared their Intermediate level of Company Secretary become eligible to register in the CA course directly with Intermediate level, without passing CA Foundation.

- CMA Students:- Students who have cleared the Intermediate level of Cost Accountant will become eligible to register directly through the CA Intermediate.

Steps to Become CA through Direct Entry Route

- Register for CA Intermediate Course

- Pass any single group of CA Intermediate

- Enrol for CA Articleship Training

- Pass both groups of CA Intermediate

- Register for CA Final

- Pass both groups of CA Final

- Apply for ICAI Membership.

Note – Students have to register themselves on or before 1st March/ 1st September to appear in Nov/ May exams respectively.

CA Course Details

Here, is the tabular representation of the CA Course at all three levels, Foundation, Intermediate, and Final:

| Events | CA Foundation | CA Intermediate | CA Final |

|---|---|---|---|

| Eligibility | Pass Class 12th Examination | Pass CA Foundation or UG/PG | Pass CA Intermediate level and Complete Articleship Training |

| Last date to Register for May 2024 | Feb 1, 2024 | Jan 1, 2024 | Jan 1, 2024 |

| Examination held | May and November | May and November | May and November |

| Registration Validity | 3 years (6 attempts) | 4 years (6 attempts) | 5 years (10 attempts) |

| Subjects | 4 | 6 (3 in each group) | 6 (3 in each group) |

| Fees | Rs 11300 | Rs 27200/23200 | Rs 39800 |

Important Note: ICAI will implement CA new scheme from the 2024 attempt. Students can check the possible changes that will be made by ICAI from the given link.

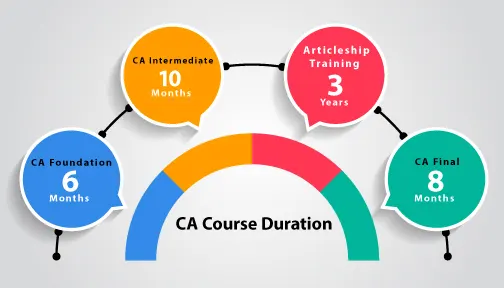

CA Course Duration

It will take a minimum of 5 years to become a CA in India after the 12th class. However, graduated students will need 4.5 years to become a CA. The period of 6 months is saved through the direct entry route.

The students must note that with every failed attempt CA Course duration will be increased by 6 Months.

Why Build a Career in Chartered Accountancy?

Chartered Accountancy is one of the best career options for commerce students. Let’s see in detail the benefits of choosing CA as a career option.

- High Salary: CA is one of the highest-earning professions in India. A fresher CA salary is Rs 7-8 Lakh and which rises to 30 Lakh after 4-5 years of experience.

- High Future Scope: With the boom in the financial industry, the scope of Chartered Accountancy is rising every year. Also, with the development of new businesses and a growing industry, only the demand for CA will increase in the Future.

- Secure Career Option: CA is considered to be the best secure option, the demand for CA is never going to end.

- Many Career Choices: After becoming a CA, you may have many career choices, like being a consultant, teaching, or working at a self-owned firm. If I talk about job roles, then you may have options like a financial banker, auditor, accountant, financial manager, etc.

What is the Salary of a Chartered Accountant?

The Average Salary of CA in India starts from 6-7 Lakh rupees and can go up to 40 Lakhs. The Big 4 companies, as well as organizations in the industrial sector, pay the majority of the top CA salaries in India. However, if we talk about the Salary of CAs Outside India then the annual packages range around 7 to 8 Lakh rupees.

Job Roles for Chartered Accountants

A candidate who has passed the CA Examination is eligible for the following job opportunities. However, there are different sectors related to finance and taxation. So, there are various career options for them.

Frequently Asked Questions

Q1. What are the steps to become a Chartered Accountant in India?

Ans: Follow the steps to become CA

- Pass the ICAI Foundation Exam

- Pass the ICAI Intermediate Exam

- Complete Three Years of Articleship Training

- Clear ICAI Final Exam

Q2. In how many years I can become a Chartered Accountant?

Ans: It requires a minimum of 4.5 years to become CA.

Q3. What is the average salary of a Chartered Accountant in India?

Ans: The average CA salary in India is INR 6-7 Lakhs. It can raise to 40-60 Lakhs depending upon the skills and Experience.

Q4. When should I pursue Chartered Accountancy courses?

Ans: Candidates can pursue Chartered Accountancy courses after the 12th or even after graduation. Also, students can enrol for the ICAI course after the 10th and appear for the exams after the 12th.

Q5. What are the eligibility criteria for class 12th students to appear for the Chartered Accountancy courses?

Ans: The eligibility criteria for students of class 12th commerce is they need to score 50% marks in their board exams. And non-commerce background students, need to score 55% marks in the board exams.

Q6. What is the fee structure of Chartered Accountancy courses?

Ans: The fee structure of all three levels of Chartered Accountancy is explained by the CA Wizard. Visit the CA wizard to check the CA course fee structure.

Q7. How to become Chartered Accountant after 12th class?

Ans: To become a Chartered Accountant after class 12th students have to be eligible for the ICAI foundation level first. Afterwards, students can become Chartered Accountants by following the above-discussed steps.

Q8. How to Become Chartered Accountant after Graduation?

Ans: Students can become Chartered Accountants after graduation through the direct entry route. The procedure to become CA from the direct entry route is mentioned above. Students can get the complete details from there.