The full form of the CMA course is Cost and Management Accounting. Nowadays, the CMA course in India is opted by many students. The course is divided into three levels: i.e. Foundation, Inter & Final. However, to become a CMA, students must pass these three-course levels. The course is mainly opted by students who want to build up their careers in Cost and Management Accounting.

Further, in the article below, we will see the CMA Course details, duration, Syllabus, eligibility, passing criteria, and much more.

TABLE OF CONTENT

- CMA Course – An Overview

- What is CMA?

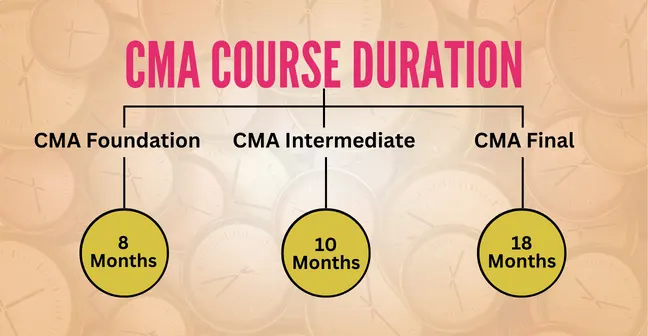

- CMA course Duration

- How to Register for CMA Course

- CMA Course Fees Structure

- CMA Course Syllabus and Subjects

- CMA Course Study Material

- Cost and Management Accountant Exam Details

- CMA Exam Pattern For All Levels

- CMA Exam Dates June 2024 Exams

- How Do Students Get Exemption in CMA Exams

- How to Check ICMAI CMA Results

- Career Options After CMA

- CMA Salary in India

- How to Become a CMA in India

- Advantages of Pursuing CMA

- Difference Between CA and CMA

- Frequently Asked Question

CMA Course Details– An Overview

Firstly, let’s see the basic details about the CMA Course.

| Particular | CMA Course Details |

| Course Name | CMA India |

| CMA course Full Form | Cost and Management Accoutants |

| Regulating Body | The Institute of Cost Accountants of India |

| CMA Course duration | 3 Years |

| CMA Course Fees | INR 100,000 |

| Academics | 20 Papers and 3 Levels |

| Recognization | India |

What is CMA?

The CMA stands for Cost and Management Accountants of India. This is a professional course by the Institute of Cost Accountants of India (ICWAI). The course was set up to promote and regulate India’s cost and management professions. Further, the CMA is the only person who can audit the cost accounts of India. In this course, the students will deal with the subjects like cost accounting, management, tax, law, etc.

Also read: Course Guide for CA

Duration of Cost and Management Accountant Course

The course duration of CMA after class 12th is three years. However, this is the duration when you pass the exam in a single attempt. Every failure attempt will increase the duration by 6 Months. Also, this does not include 15 Months of articleship training.

Also check: Duration for CA Course

Eligibility Criteria of the CMA Course

Before applying for the course, you must first know about the eligibility criteria of the course. Let’s see the eligibility criteria for the CMA Course at each level:

Foundation Course

- The candidate must have passed the Class 10th exams from a recognized board.

- Passed the class 12th examination from a recognized board or an examination recognized by the central government.

- Also, the students who have passed the National Diploma in commerce exams under AICTE or any other recognized body under all India Council.

- Moreover, the candidates waiting for the Class 12th Result are also eligible for provisional registration for the CMA Foundation Course.

Intermediate Course

- The candidate who has passed the Foundation level of the cost accountants of India or Graduation in any other discipline.

- Passed the Intermediate Level of ICSI (Company Secretary) and the intermediate level of Chartered Accountants of India.

Final Course

- The candidate who has passed the Intermediate level of CMA.

- The candidate must have completed 15 months of training.

How to Register for CMA Course?

So, if you are eligible for the course, then quickly register for the course. The candidates can register themselves on the official website of ICAMI. Now follow the steps to fill out the CMA Registration form.

- Firstly, open the ICAMI official website and click on the CMA Foundation Registration.

- Now, enter the required details and click on save, and continue.

- Next, upload the scanned copy of the documents required.

- Afterwards, make the payment for your respective courses through the online method.

- Now, pay the CMA Foundation registration fee of INR 6000.

- Now, get the printout of the registration form for future use.

Therefore, the registration process for the CMA Intermediate and CMA Final level is the same. The only difference is you need to submit different documents.

Documents Required for CMA Registration

- A Passport Size Photo

- Signature of a Candidate

- Class 10th Marksheet (for CMA Foundation)

- Class 12th Marksheet (for CMA Foundation)

- CMA Foundation Marksheet (for CMA Intermediate)

- CMA Intermediate Marksheet (for CMA Final)

- 15 Months training Certificate (for CMA Final)

Further, the students to note that registration for the CMA course is open throughout the year. To register for the CMA June attempt, student must fill out the registration form before 1 Jan of that year, and to register for the December attempt, the student must fill out the registration form by 1st July of that year.

CMA Course Fees Structure for Foundation, Intermediate, and Final

The total CMA Course fees in India is Rs. 53000 approx. This only includes the registration fees.

| Course Name | Fees |

| Foundation | Rs.6000 |

| Intermediate | Rs.22,000 |

| Final | Rs.25,000 |

CMA Course Syllabus and Subjects

The CMA course is divided into three levels, i.e. CMA Foundation, Intermediate, and Final. However, the CMA Foundation consists of 4 subjects, whereas CMA Inter and Final is comprised of 8 subjects which are divided into two groups, four each.

CMA Foundation Syllabus

- Paper 1: Fundamentals and Economics of Management

- Paper 2: Fundamentals of Accounting

- Paper 3: Fundamentals of Law and Ethics

- Paper 4: Fundamentals of Business Mathematics and Statistics.

CMA Intermediate Syllabus

Group 1:

- Paper 1: Financial Accounting

- Paper 2: Law and Ethics

- Paper 3: Direct Taxation

- Paper 4: Cost Accounting

Group 2:

- Paper 5: Operations Management & Strategic Management

- Paper 6: Cost & Management Accounting and Financial Management

- Paper 7: Indirect Taxation

- Paper 8: Company Accounts & Audit

CMA Final Syllabus

Group 1:

- Paper 1: Corporate Law and Compliance

- Paper 2: Strategic Financial Management

- Paper 3: Strategic Cost Management – Decision Making

- Paper 4: Direct Tax Law and International Taxation

Group 2:

- Paper 5: Corporate Financial Reporting

- Paper 6: Indirect Tax Law and Practice

- Paper 7: Cost and Management Audit

- Paper 8: Strategic Performance Management and Business Evaluation

CMA Course Study Material

The CMA course study material for the 2024 exams is available on ICMAI official website. Students can download the PDF of the study material or order it online from the official website.

Students are advised to prepare for CMA exams only from ICMAI study materials. Because they contain the relevant topics for the 2024 exams and are based on the CMA examination pattern. Students can download CMA course study materials from the below table:

Cost and Management Accountant Exam Form

The CMA Exams are held twice a year, in June and December. Students are required to fill CMA exam form after registration. Without an exam form, students are not allowed to appear in the examination.

CMA Application Form

The candidate must fill out the examination form to take the CMA exam. Check the due date of the application form and fill it out before the last date.

Steps to fill out the CMA application form:

- Visit the official website of ICAMI.

- Click on the admission tab.

- Now, click on the course that you want to apply for.

- Fill out all the necessary details, including personal, address, and qualification details.

- Afterwards, proceed to pay the application fee and submit the application form.

CMA Application Fees

Check the table below to know the CMA application fee:

| Examination | Application Fee (India) | Application Fee Overseas students |

| Foundation Course | Rs.1200 | $60 |

| Intermediate Course (Single group) | Rs.1200 | – |

| Intermediate Course (Both Groups) | Rs.2400 | $90 |

| Final Course (Single Group) | Rs.1400 | – |

| Final Course (Both Groups) | Rs.2800 | $100 |

CMA Exam Pattern For All Levels

Students must be updated with the exam format of every level before attempting any of the CMA course exams. The examination pattern informs you about the types of questions which will be asked, the period of time limit, the weightage of certain chapters, and the expected number of questions. All of the levels are held two times a year.

Let’s have a look at the CMA examination pattern at each level.

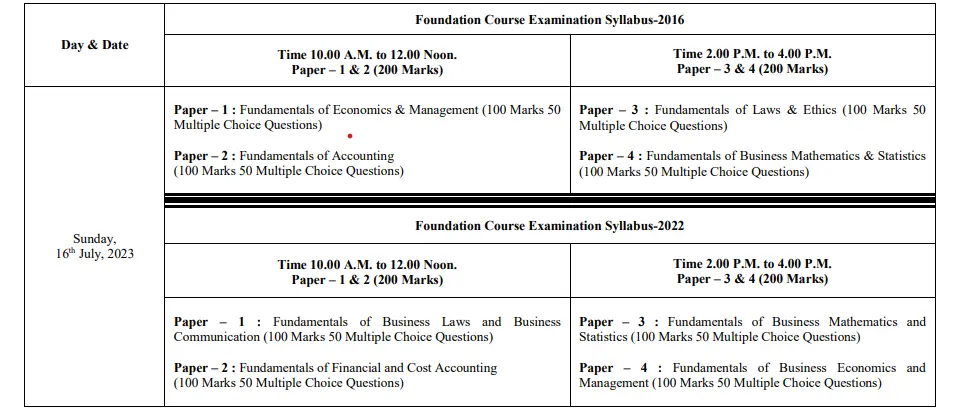

CMA Foundation Examination Pattern

As per the CMA foundation examination pattern, students get 3 hours for each paper. All these papers are of 100 marks. Additionally, students get 15 mins to review the CA Foundation question papers.

The CMA Foundation question paper includes descriptive and objective types of questions without negative markings. The objective-type question carries a weightage of 60% and the descriptive-type question carries a 40% weightage. Students need to do consistent practice CMA foundation sample papers according to the pattern of the exams to make a flow till the main exams.

CMA Intermediate Exam Pattern

CMA Intermediate level has a total of 8 papers of 100 marks each. These 8 papers are divided in equally in two groups. Like CMA Foundation, students get three hour for each paper in this level.

Additionally, CMA intermediate papers also contain descriptive and objective types of questions. Further, the question distribution is also same as the CMA foundation and has no negative markings for wrong answers. Students need to score aggregate of 50% marks and 40% on each paper individually.

CMA Final Exam Pattern

CMA final level also has a total of 8 papers of 100 marks each which are divided equally into two groups. Further, students get 120 questions to solve in 3 hrs in CMA final papers.

Furthermore, CMA final paper pattern and passing criteria are the mostly same as CA intermediate level.

CMA Exam Dates June 2024 Exams

The CMA exam dates for June 2024 exams are 11th June to 18th June, 2024. The CMA exam timetable is available on the official ICMAI website. Students can download it from the official website or from the below content.

CMA Foundation Exam Dates June 2024 Exams:

The CMA Foundation June 2024 exam will be held on 16th June 2024 for both the 2016 and 2022 syllabus. Here, students can check the official CMA Foundation timetable:

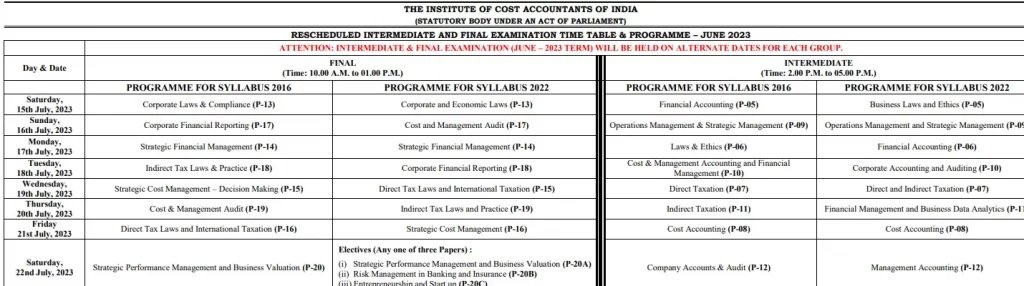

CMA Intermediate and Final Exams Date June 2024 Attempt

CMA intermediate and final level exams will be held from 11th June to 18 June 2024. The official timetable sheet is mentioned below:

How Do Students Get Exemption in CMA Exams?

If a student failed to clear a group, but he scores 60+ marks in any paper of a particular group. Then, they will be exempted to appear for that particular paper in further attempt. Moreover, if a student scores 60+ marks in any paper and 40 marks in the remaining paper, then the exempted paper marks will be carried forward in the next attempt.

How to Check ICMAI CMA Results?

After forty days or six weeks after the end of the tests, students will receive their results. The outcome will be posted on the ICMAI website. Additionally, a minimum score of 360 out of 500 is required to pass the CMA Exam.

Follow these steps to verify the result:

- Visit the ICMAI website’s examination part by clicking here.

- The “Result” tab can be seen on the left side of the page as you scroll down. Thus, click on it.

- Select the relevant link.

- The exam results can then be examined.

You can also check the CMA result 2024 dates.

Career Options After CMA

After completing CMA there are various career opportunities, let’s have a look at them:

- Financial Manager

- Financial Analyst

- Chief Financial Officer

- Financial Controller

- Corporate Controller

- Chief Investment officer

- Cost Accountant

The average salary of a CMA in India is 7-10 lakhs. However, your experience and skills can raise your salary to 20 Lakhs.

CMA Salary in India

The average annual salary of a CMA in India is 10 Lakh INR. Hence, a CMA Earns around Rs 83,000 per month in India. Furthermore, the Highest CMA Package given by the top companies is Rs 22 Lakhs per annum.

However, the Salary of a CMA increases as per their Knowledge, skills and experience. The average package of CMA in India depends upon many factors such as job profile, Location, expertise, and industry in which they work.

According to the ICMAI, the average salary of a fresher CMA in India is Rs 10 Lakh. However, in the year 2022, we have seen the salary raise of CMA by 30%.

Further, check the table below to know the highest, lowest and average salaries of CMA in India.

| Particulars | CMA Salary per Annum | CMA Salary per Month |

|---|---|---|

| Starting Salary | Rs. 6.5 Lacs | Rs. 54,000 per month |

| Lowest Salary | Rs. 2 Lacs | Rs. 16,000 per month |

| Highest Salary of Fresher | Rs. 22 Lacs | Rs. 183,000 per month |

| CMA Average Salary in India | Rs. 10 Lacs | Rs. 83,000 per month |

| Highest CMA Salary | Rs. 55 Lacs | Rs. 458,000 per month |

How to Become a CMA in India?

- Register for the CMA course in India and meet the CMA Foundation eligibility requirements.

- To advance to the next level, prepare for the tests and pass them with at least a 40% score.

- Enrol in the intermediate CMA course.

- After passing both CMA Inter groups, sign up for the 15-month practical training.

- Sign up to take the CMA Final examinations.

- Complete the practical training while also studying concurrently for the final tests.

- You’ll become a Cost and Management Accountant once you pass both sets of final exams.

- Finally, submit an ICMAI membership application.

To become a Cost and Management Accountant, students must pass 20 papers in total.

Advantages of Pursuing CMA

To pass the CMA examinations, you must put in a lot of effort and attention. But let’s not overlook the benefits one can obtain from passing the course. Find out the benefits of enrolling in a CMA course by reading the list below:

- Growth Potential

- Better Salary

- Global Opportunities

- CMAs are high in Demand.

- Business Appeal

Difference Between CA and CMA

CA and CMA are fascinating courses with their place and value in the corporate world. However, both courses are considered to be the toughest. If you choose between CA and CMA, you must be interested in numbers.

Let’s see the fundamental difference between CA vs CMA in the table:

| Basis | CA | CMA |

| Course Structure | 3 Levels CA Foundation CA Intermediate CA Final | 3 Levels CMA Foundation CMA Inter CMA Final |

| Duration | The total duration of the course is 5 Years | The total duration of the course is 3 years |

| Course Fees | The total course fee is 2-3 lakhs | The total course fee is around 50-60 thousand. |

| Market Demand | The market demand for CA is very high and still increasing. | The market demand for CMA is limited but can have high scope in the future. |

| Average Salary | 7-8 Lakhs (Fresher) | 3-4 Lakhs (Fresher) |

Frequently Asked Question

Q1. What is CMA?

Ans: CMA is the professional course offered by the Institute of cost accountants of India, which was set up to promote and regulate the cost and management accountancy profession in India.

Q2. What is the Eligibility of a CMA Course?

Ans: The student is only eligible for the CMA course if they have passed the Class 12th Examination or equivalent from a recognized board.

Q3. What is CMA Salary in India?

Ans: The average salary of a CMA is 7-10Lakhs; it increases as per your experience and skills.

Q4. Is CMA tough than CA?

Ans: CA is tough than CMA, in terms of Syllabus, content, and exam level.

Q5. Which is the best CMA Coaching institute in India?

Ans: There are many best institute for cma in india but VSI Jaipur is considered as the best coaching for CMA in India. You can also check from the list of top 10 cma coaching in India of CA Wizard.